Buying a house is often regarded as one of the most significant milestones in one’s life, brimming with excitement and anticipation. However, amidst this exhilarating journey lies a question that often crosses the minds of prospective homeowners: how long does it truly take to purchase a house? With a myriad of factors influencing the timeline, this venture can become a bit of a conundrum. What if the time it takes feels like the tortoise in the race against the hare? Let’s delve into the labyrinthine process of home buying, shedding light on what you can expect along this winding path.

The duration required to purchase a home can vary significantly from one individual to another. Overall, the process can take anywhere from a few weeks to several months or, in rare cases, even longer. Several key phases contribute to the timeline, each with its own unique challenges and potential delays. Understanding these stages can help you navigate the waters of homeownership more smoothly.

1. Financial Preparation: The Foundation of Your Journey

Before you even begin searching for your dream home, it’s essential to establish your financial footing. This phase typically takes anywhere from a few weeks to a couple of months, depending on your current financial situation. Here are some necessary steps:

- Evaluate Your Finances: Review your savings, credit score, and debt-to-income ratio. This assessment allows you to understand how much you can afford.

- Pre-Approval for a Mortgage: Obtaining pre-approval from a lender can take a few days to a couple of weeks. This step is crucial as it informs sellers of your seriousness and helps you set a realistic budget.

- Save for a Down Payment and Closing Costs: Depending on your situation, saving the necessary amount may take time. Many lenders recommend a 20% down payment, but this can vary.

Imagine putting together a puzzle; without the right pieces, the full picture remains elusive. Without sufficient financial preparation, your home-buying journey may stall before it even begins.

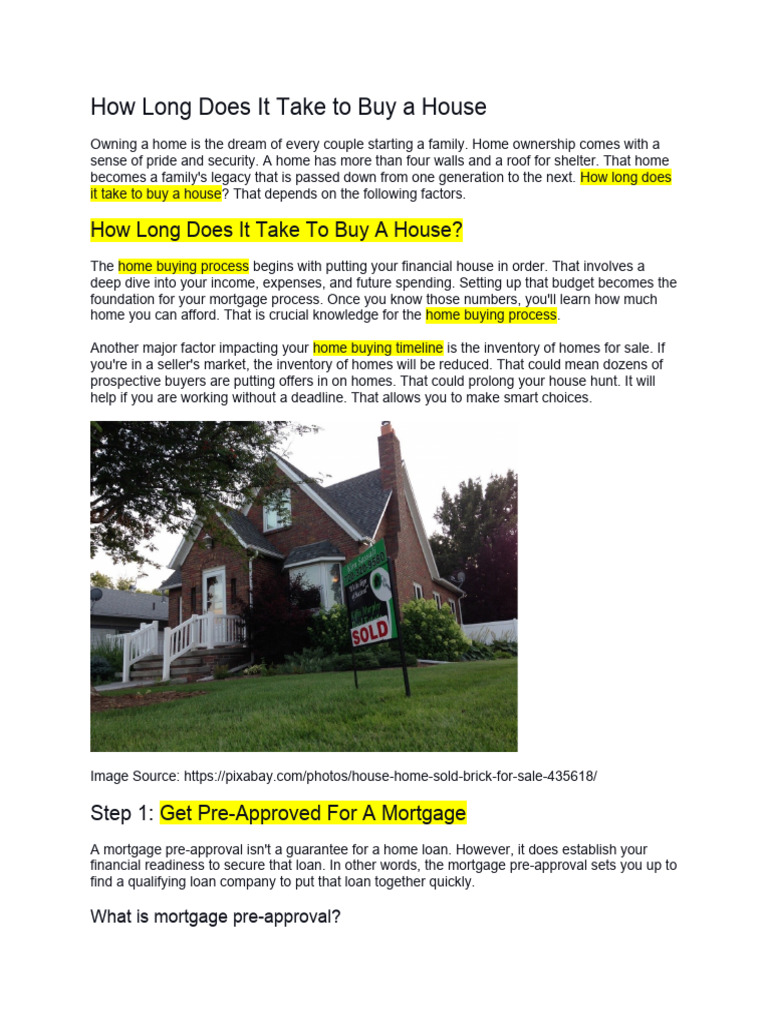

2. The Home Search: Scavenger Hunt for the Perfect Nest

Once your finances are in order, the real fun begins. The home search can range from a few weeks to several months. Here’s what to expect:

- Defining Your Needs: Create a comprehensive list of must-haves and deal-breakers. Identify your preferred neighborhoods, home sizes, and amenities.

- Working with a Real Estate Agent: A knowledgeable agent can expedite this process. They will provide listings, schedule showings, and assist in negotiations.

- Attending Open Houses: You may find the ideal home right away, or it might take visiting countless properties to strike gold.

The thrill of discovery mingles with trepidation; a heightened awareness that you are literally examining potential chapters of your life within those four walls. The timeline can fluctuate significantly based on preferences and the current real estate market conditions.

3. Making an Offer: The Art of Negotiation

After finding the home that evokes the joy of ownership, it’s time to make an offer. This aspect can take a few days to several weeks, depending on various factors:

- Crafting Your Offer: Collaborate with your agent to determine a competitive yet reasonable offer that reflects the home’s market value.

- Negotiations: Expect some back-and-forth with the seller, especially in a hot market. The negotiation process might feel like a dance, requiring finesse and patience.

- Contingencies: Include contingencies in your offer, such as a home inspection or financing. These can add time to the overall process.

This moment can feel like standing at a crossroads, filled with potential yet fraught with uncertainty. Each player’s response can ultimately dictate the pace toward homeownership.

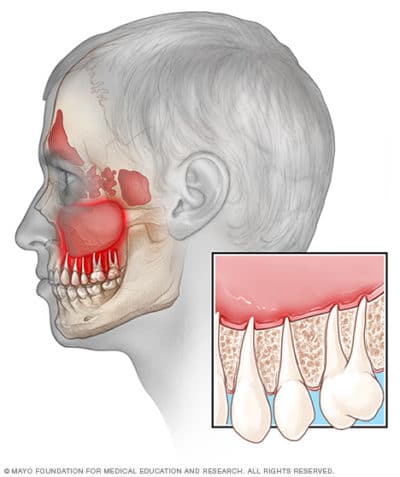

4. Undergoing Inspections and Appraisals: Unveiling the Home’s Secrets

Once an offer is accepted, the next steps often encompass home inspections and appraisals, which can add anywhere from a week to a month to the timeline. These steps are critical for validation:

- Home Inspections: A thorough inspection reveals hidden issues, which can sometimes alter the original agreement if repairs are needed.

- Appraisal: The lender requires an appraisal to confirm the home’s market value aligns with the loan amount. Delays in scheduling can occur due to various factors.

These processes are like opening a door to a hidden room filled with unknowns. Unearthing issues can complicate matters, extending the timeline as negotiations resume.

5. Closing the Deal: The Grand Finale

The closing stage generally takes about 30 to 60 days after the offer is accepted. This period is both exhilarating and daunting:

- Finalizing Financing: Ensure all paperwork is in order, and confirm your loan terms with the lender.

- Signing Documents: Closing day involves a significant amount of paperwork. This can feel overwhelming, but it is the final field of the marathon.

- Transfer of Ownership: Once all documents are signed and funds are transferred, the house is officially yours!

The rush of finality ignites a plethora of emotions. However, it is essential to stay vigilant, as hidden nuances in paperwork may surface during these final steps.

Conclusion: Embrace the Journey

Purchasing a house can indeed feel like a complex labyrinth, taking anywhere from a few weeks to several months depending on myriad factors. Recognizing and understanding each phase can demystify the process, allowing you to navigate the path to homeownership with greater confidence and clarity. Remember, while the timeline may be variable, the goal of finding a space to call your own is a quest worth every moment of patience invested. Will your quest lead you to the sanctuary you envision, or will it reveal unforeseen challenges along the way? Keep your spirits high; the journey itself can be as rewarding as the destination.

Leave a Comment