As a nation deeply invested in the pursuit of wellness, the question of whether physical therapy is covered by insurance often looms large in the minds of many. Physical therapy serves as a linchpin in the recovery process, enabling individuals to regain mobility, strength, and a sense of normalcy following injuries, surgeries, or chronic conditions. However, navigating the labyrinthine world of health insurance can be daunting. Are you curious about the financial implications of physical therapy? Let’s traverse this pivotal inquiry.

Understanding the Basics of Physical Therapy Coverage

Before delving deeper into coverage specifics, it is essential to comprehend the underlying principles that govern physical therapy and insurance. Physical therapy is designed to alleviate pain, restore function, and avert disability. Depending on your condition, it may involve a series of treatment modalities, including exercises, manual therapy, modalities like ultrasound, and education regarding lifestyle changes. Given the diverse nature of physical therapy, coverage can vary remarkably across different insurance plans.

Types of Insurance Plans and Their Coverage

When it comes to health insurance, there are several types of plans that play a critical role in determining whether physical therapy is financially covered. Here are the primary categories:

- Employer-sponsored Health Insurance: Most individuals receive health insurance through their employer, and coverage for physical therapy services can vary widely. While some employers provide comprehensive plans that adequately cover therapy, others might impose limitations or require higher out-of-pocket expenses.

- Medicare: For those aged 65 and above or individuals with specific disabilities, Medicare offers coverage for physical therapy under Part B. However, there are stipulations related to eligibility, frequency of visits, and the necessity for medical documentation.

- Medicaid: This government program assists low-income individuals, with coverage for physical therapy differing by state. Understanding the local jurisdiction is paramount, as benefits can be influenced by state policy.

- Private Insurance: Those with private insurance plans must scrutinize the coverage details, including limits on the number of sessions and any copayments or deductibles that may apply.

Key Factors Influencing Coverage Decisions

Navigating insurance parameters requires awareness of several nuanced factors:

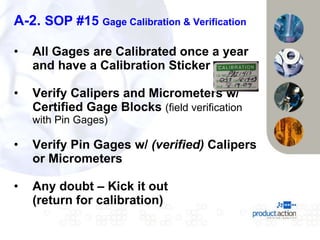

- Pre-authorization Requirements: Insurers may require pre-approval before granting coverage for physical therapy. This step entails documentation justifying the necessity of the treatment, which can be a tedious process but is pivotal for obtaining coverage.

- Network Providers: Many plans have a network of preferred providers. Opting for an out-of-network therapist can lead to a significant rise in out-of-pocket expenses, making it crucial to identify in-network professionals.

- Annual Limits: Some plans impose annual caps on the number of allowed physical therapy sessions. If you have chronic conditions necessitating ongoing treatment, these limits can be a financial burden.

What to Expect During the Physical Therapy Journey

A typical physical therapy experience begins with an assessment where the therapist evaluates your condition, discusses your goals, and formulates a tailored treatment plan. The therapist often works in tandem with your physician for cohesive care. As treatment progresses, communication with your insurance provider becomes vital. Maintaining meticulous records of appointments, treatments, and communication with your provider can aid in ensuring coverage continuity.

Comparing Out-of-Pocket Costs

Understanding your financial responsibility is essential. Out-of-pocket costs can vary significantly based on plan details. For practitioners working with non-covered services, exploring payment plans or financial assistance programs may offer a crucial lifeline. Consider the following:

- Deductibles: Many plans require you to meet a deductible before coverage kicks in. This amount varies, so review your plan’s specifics.

- Copayments: Patients may be charged a copayment per session. Evaluate the cost against the potential benefits to ascertain affordability.

- Coinsurance: Some plans may require you to pay a percentage of the total bill beyond the deductible, impacting overall treatment costs.

Tips for Maximizing Insurance Benefits

For those seeking to optimize their insurance benefits, consider these actionable suggestions:

- Clarify Coverage Details: Contact your insurance provider ahead of initiating treatment to grasp the extent and limitations of your coverage.

- Obtain Needed Referrals: Ensure you have a referral from your primary care physician if your plan necessitates one for therapy to be covered.

- Keep Detailed Records: Maintain comprehensive records of all treatments and communications with your insurer, as this can streamline claims processing.

- Explore Flexible Spending Accounts: For those with FSA or HSA accounts, understand how these can be leveraged to cover therapy costs.

The Takeaway

In the grand tapestry of healthcare, understanding whether physical therapy is covered by insurance illuminates a path toward recovery and wellness. While coverage can indeed be a quagmire, arming oneself with knowledge and preparation is paramount. Familiarizing yourself with your insurance plan, being proactive in communication, and taking an informed approach can pave the way for a successful and financially manageable healing journey. As you embark on the road to recovery, consider not only the immediate benefits of physical therapy but also the lasting impact on your quality of life. After all, investing in your health today can yield dividends of vitality and well-being for years to come.

Leave a Comment